Destination and Dealer Charges Quick Facts

- Every new car buyer pays a destination charge, also called a freight fee or freight delivery charge. Carmakers charge this fee to deliver the vehicle from the factory to a dealership.

- Destination charges are not negotiable, though some dealer fees can be.

- Question everything on your sales invoice, including any dealer doc fees, when buying a car.

When buying a new car, it’s important to remember that the “for sale” price is never the final amount because dealer fees and destination charges usually get added to the invoice.

We break down dealer fees, destination charges, and other line items that show up on your window sticker and the final sales invoice. Not sure what a vehicle will cost? Check out our research, car reviews, and payment calculator.

- What Is a Destination Charge?

- How Much Are Destination Charges?

- Are Destination Charges Negotiable?

- What Are Dealer Fees?

- List of Common Dealer Fees

- Tips for Negotiating Dealer Fees

What Is a Destination Charge?

A destination charge, often called a freight fee or freight delivery charge, is fixed and ensures that new car buyers pay equally to cover the cost of delivering a vehicle to a dealership. Manufacturers typically set a car’s destination charge on a model year basis. New car buyers pay the charge regardless of whether the dealership is near or far from the vehicle assembly plant. Used car buyers do not need to pay destination charges since the original owner paid them.

According to United States law, car delivery — transporting the vehicle from a port or assembly plant to a dealer showroom — always gets listed as a separate line item on a new-car window sticker. Automakers may use different names to describe it, but it always works the same way, with buyers covering the cost.

How Much Are Destination Charges?

Destination fees range from about $995 to around $2,295 for vehicles like the 2024 GMC Hummer EV ($2,295). Charges depend on the car manufacturer and the vehicle’s make and model.

So, how do you find out what the destination fees will be? The charges vary depending on the brand or even the model. Check the window sticker on the vehicle you like to find the destination fee. Some automobile manufacturers, like Chevrolet, GMC, and Honda, make the research easy by listing destination charges on their websites.

For example, destination fees for a 2024 Chevy Malibu cost $1,095. Chevy set its 2024 Silverado 1500 fees at $1,995. A 2024 Honda CR-V buyer pays the $1,350 destination charge — whether in Seattle or Indianapolis, thousands of miles closer to the Greensburg, Indiana, plant where the CR-V gets built.

Larger, heavier, or more expensive vehicle models, such as the GMC Sierra 2500 HD Denali, can be more costly for the automaker to move. A high-end luxury vehicle may also require more careful protection before making a trip by rail or truck. The destination charge for an exotic Lamborghini model like the Urus can add as much as $3,995 to a vehicle price that already exceeds $200,000.

Wrapping the car in protective film or transporting it in a closed truck adds costs, which result in a higher destination fee. Imported vehicles don’t necessarily have higher delivery fees than domestic models. The fee covers only delivery inside the U.S. — foreign automakers usually cover the cost of getting their vehicles to dealer showrooms.

Are Destination Charges Negotiable?

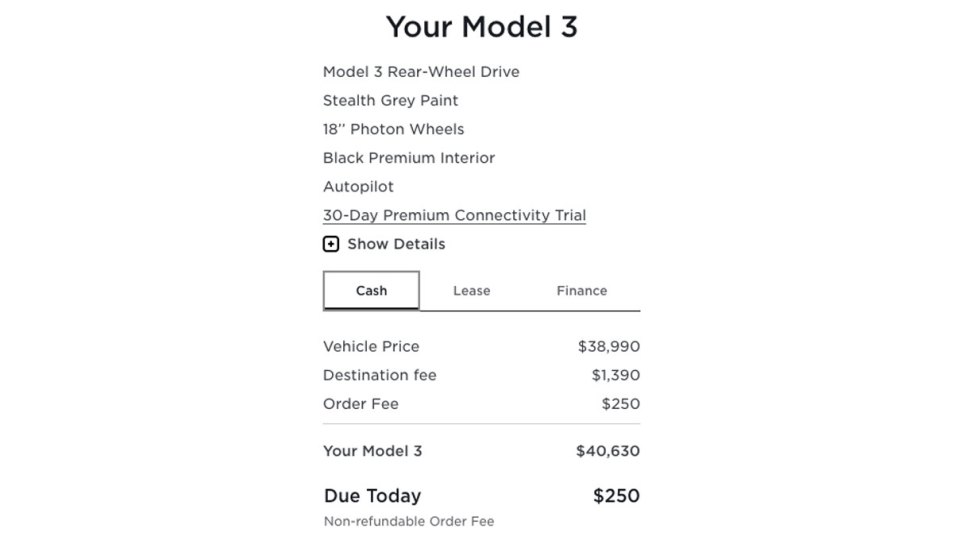

Destination charges are not negotiable whether you buy the new car in a dealership or online, like a Tesla ($1,390 destination fee). Dealers will not negotiate on car destination fees set by the manufacturer, and these charges are usually not waived. Though you can find it on the window sticker, the MSRP, or the manufacturer’s suggested retail price, does not include the fee.

Although there’s no getting around a delivery charge at the negotiating table, new car shoppers can prepare for it — and avoid surprises — by considering it when researching vehicles.

Before purchasing your new vehicle, be sure the destination charges on the sticker price match the ones in the final sales price.

TIP: Dealers sometimes add a second destination and delivery fee. If you request car delivery to your home, that’s the only time you may need to pay a second delivery fee. If you see this in your final invoice price and did not request delivery, ask the dealer to remove the charge. This fee applies to used cars, too.

What Are Dealer Fees?

Dealer fees range in cost and add to the overall cost of your car if you don’t question them on your sales invoice. Some dealer fees you need to pay, while others, you don’t. Dealer fees range from car tax to dealer documentation or doc fees. In an attempt to offset tariffs on imported cars and car parts, you may notice new fees when buying your next car. Read on to see the common fees you need to know about.

List of Common Dealer Fees

Check dealer fees carefully, especially ones marked by unusual acronyms. See our list below of typical dealer fees defined, plus which ones to avoid.

- Tax:

- Whether it’s called a sales tax, vehicle tax, or ad valorem tax, car buyers must pay a mandatory tax to buy a car if it’s required where they live.

- Some states, like Alaska, Delaware, Montana, New Hampshire, and Oregon, do not charge taxes on cars. It’s also confusing because some states will ask for sales tax plus additional types of tax. In California and Virginia, you can expect to pay a vehicle tax in addition to sales tax. According to the state of Virginia, the vehicle sales and use tax is 4.15% based on the vehicle sales price or $75, whichever is greater, according to the Virginia Department of Motor Vehicles. An exception to the state sales tax collection is Georgia. This state changed its laws in 2013. Instead of sales tax, car owners pay a one-time Title Ad Valorem Tax as the vehicle gets titled. According to the Georgia Department of Revenue, owners must pay this even when vehicles change hands or move into the state.

- Dealers calculate sales tax before deducting incentives and rebates. Bottom line: Research your state’s tax regulations before buying a car and understand how the collection affects your final sales price.

- Title and registration

- Dealers pay these fees to process the title and registration of the car. It’s a standard fee and saves car owners a trip to the DMV. However, if you trade in another vehicle, sometimes you can transfer tags to the new car.

- Find out how much title and registration costs in your state before buying a car. Then, make sure the charges seem reasonable for the dealer to handle this paperwork.

- If these get lumped in with documentation fees, ask for a breakdown of the charges (more on that below).

- Delivery

- If you see a delivery fee in the final charges for the vehicle, you can ask to remove it unless you need the car delivered.

- Documentation

- Sometimes known as a “doc” fee, these fees cover the sales documentation preparation costs. Some states regulate these fees. For example, California requires that dealers charge car buyers no more than $85 for dealer documentation fees.

- Reconditioning

- When you buy a used car, dealers often detail and deep clean the vehicle. They’ll also top off all fluids and generally get the car in shape to sell. The reconditioning fee covers this service. Dealers like to pass this on to consumers. However, the sales price takes this into account. This is a fee you don’t need to pay.

- Vehicle preparation

- A dealer prep fee covers the costs of car washing and other preparations to get the car ready to sell. It also includes removing all the plastic wrapping on the seats. Do you need to pay for it? No.

- Advertising

- Generally, buyers need to pay advertising fees.

- Dealers pay advertising fees to participate in regional or national advertising programs. The expenses get passed on to consumers legitimately. However, you can compare the final price to other dealers in the area. If the cost is listed in the final price, the dealer could be attempting to pass off additional charges. So, pay attention and ask questions if fees seem excessive.

- If the dealer provides advertised manufacturer cash-back incentives of $1,000 and your advertising fees on the final price are $1,000, consider it a red flag.

- Additional dealer markup

- Sometimes seen as ADM (additional dealer markup) or ADP (additional dealer profit), this cost does not need to be paid by you. It’s just one more acronym you don’t need to pay for — so don’t. During the COVID-19 pandemic, some dealerships charged market adjustments. We may see the same dealer markup trend with tariffs.

- There are times when the scarce availability of vehicles creates this markup on your final invoice. However, one dealer may charge a market adjustment fee while another charges nothing. Shop around. You can always walk away before anything gets signed.

- VIN etching

- Many dealers will tell you that VIN etching is a theft-prevention tool. The dealer will etch your car’s vehicle identification number (VIN) into a corner of the vehicle’s windows. This is a common sales tactic. Etching prevents thieves from stealing your vehicle because law enforcement can readily identify it as stolen. This claim isn’t necessarily untrue. VIN etching can be a theft-prevention measure. Some insurance companies even give discounts to drivers who have it. The problem here is cost: Most dealers charge hundreds for the feature, while do-it-yourself kits cost less than $30. If the car you want already has VIN-etched windows, insist that you won’t pay the retail cost for it.

- GAP insurance

- If a dealer attempts to charge you for guaranteed asset protection insurance, or GAP, request that it be removed if you don’t want coverage.

- You can probably find it elsewhere cheaper, perhaps with your car insurer, depending on how much you put down on the vehicle. Just know that the value of your new car depreciates the moment you drive it away from the dealership.

- Factory holdback

- A manufacturer holds back a specific dollar amount from the dealer until a vehicle gets sold. However, the holdback varies by manufacturer. This holdback gets accounted for on the invoice. If it shows up as a line item in the final price, ask for it to be removed.

All charges and fees for options and aftermarket equipment already installed by the dealer must be included in the price.

Tips for Negotiating Car Fees

- Question everything. When negotiating any car fees, ask lots of questions to find out what gets included and why in the final price for the vehicle you plan to buy.

- Initially, don’t discuss financing. Until you arrive at the final vehicle price with the dealership, never discuss whether or not you plan to finance the car. Get the price first, then start those conversations.

- Keep calm. It’s not worth it to lose your cool in light of negotiations. Just stay the course. Maintaining your cool will help you negotiate better deals.

- Be prepared to walk away. Remember that many other dealerships offer the same car. Don’t become too attached at one dealership. You can always walk away from a deal and find it elsewhere.

Related Car Buying Articles:

- What Is an MSRP?

- How Much Do Dealers Mark Up a Car Over the Invoice Price?

- Buying a Car with Cash: Everything You Need to Know

- Things to Know About Taxes When Selling a Car

Editor’s Note: This article has been updated for accuracy since it was originally published.

Do you really think it cost something like $800 to do the paperwork? If you paid someone $20 an hour to do the paperwork, they would be working on that for 8 hours a day for 5 days. No, the salesperson and the finance person have done that. The Documentation Fee is really about half the dealer’s profit.

Pretty certain the “destination” fee part of this is not correct. Car dealers pay delivery/shipping fees (just as any company pays all inventory costs) not the consumer. Consumers, in fact, are not required to pay any extra fees when buying a new car outside of taxes & licensing. In Virginia, the law allows dealers to charge a processing fee, but it does NOT require them to do so. Processing, destination & the others listed above are bogus.

Thanks for reading, Marie. Destination fees passed from the automaker to dealers must be disclosed as a separate item on the window sticker and the sales contract. While that dollar amount cannot change, savvy car buyers can negotiate the bottom line to offset the charges.

Destinantion fees are included on the window sticker of the car. Dealers have no saying in charging or not charging it. What they can do is give a discount on the total of the car to help covering the destination fee but it does come included in any new car just look at the window sticker

I’m looking to get a new car. What’s the destination fee for a Tesla?

On its website, Tesla says it’s $1,390 for the destination fee as of Dec. 7, 2023. Those prices went up recently, according to one Reddit user. https://www.reddit.com/r/TeslaModel3/comments/12edua0/tesla_reduced_price_by_1000_but_also_added_70_in/

At Chevy getting my truck serviced and looking at a new Corvette with a $25,000 inland freight charge. Total rip off

How much is the destination fee for a Tesla

It’s $1,390 for the Tesla destination fee as of December 2023.

What is the destination fee for a Tesla

Tesla charges $1,390 for its destination fee on all its models. Thank you for reading, Winston.

What a ripoff, the dealer should pay delivery fees, passing it on to consumers is wrong.same as prep. Paying someone to peel plastic off vehicle is rediculous. No where else do you pay for this. I can see paying a delivery fee if you custom order your car, like it use to work. From the factory.

are destination fee and dealer setup fee (motorcycle) taxable?

Manipulative sales games. If the charges are fixed additions to the cost of the vehicle, then list that as a the price of the vehicle. Don’t hide it from buyers until they decided on the vehicle they want and you get them in the hot seat and then hand them to bottom line price tag. Destination charge especially, since that’s a fixed amount from the manufacturer, standardized nationwide.

As much as I hate to admit it, $800 is cheap for destination/transportation charges. My husband and I wanted to save a few thousand miles on our Porsche’s odometer, so we thought it would be a good idea to have it transported and we could fly to our destination (2,000+ miles away), pickup our 911, drive it on vacation then have it transported back home. We would have saved 4,000+ miles wear & tear and on the Odometer but we got quotes of $4,000-6,000 r/t depending if enclosed or open-air, including insurance. Plus they would have to pick up the car (to work with their schedule) 2 weeks earlier, so they could pick up other cars on their route, and it would take them 2 weeks to return it. All things considered, $800 isn’t too bad.

A give-back portion goes to the dealership.

Next time look at the amount of vehicles on a transport. X that by 800.00 and now your talking 8,000 or more! Who gets that money?