Quick Facts About Buying a Used Car

- Now is a great time to buy a used car. Tariffs on new cars are sending would-be buyers to consider used vehicles.

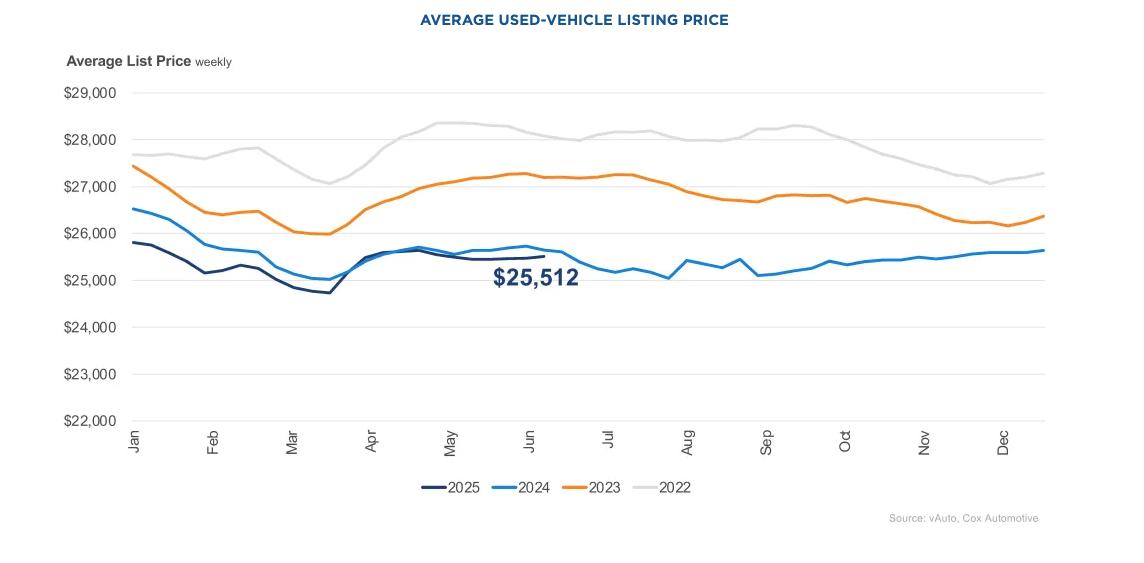

- At the start of July, the average used car listing price was $25,512, slightly higher than last year.

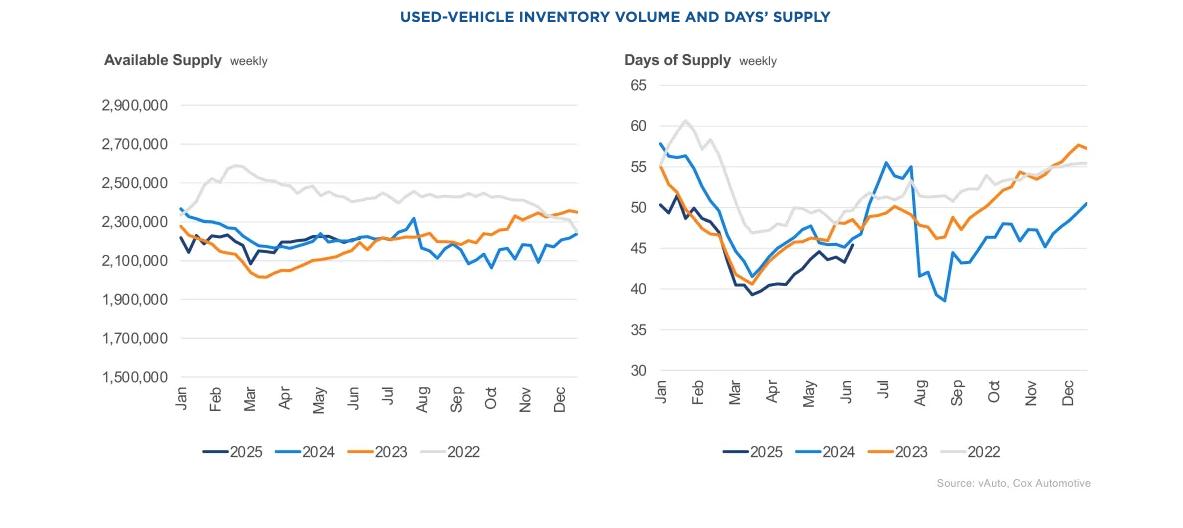

- Used-vehicle inventory remains tight, with a 45-day supply at the beginning of July, similar to last month.

Now is a great time to buy a used vehicle before prices rise and further affect affordability. New car tariffs are sending would-be buyers to used cars to try to get better deals. Greater demand is expected in the coming months, further constraining the used car supply.

Many factors can influence whether it’s a good time to buy a used car, from available inventory to interest rates. The tight supply of used vehicles could make it difficult to find exactly what you want. Also, interest rates remain higher on used vehicles than on new ones. Still, there are plenty of benefits to buying a used car right now. We explain. You can skip ahead using the jump links below.

- Used Car Market Overview

- How Much Does a Used Car Cost?

- Pros of Buying a Used Car

- Cons of Buying a Used Car

- Tips for Buying a Used Car in Today’s Market

- Bottom Line

Used Car Market Overview

The Cox Automotive days’ supply report shows that the used-vehicle supply was 45 days at the start of July, about the same as last month and two days less than a year ago at this time. The report is based on the estimated daily retail sales rate for the most recent 30-day period.

In June, nearly 1.5 million used vehicles were sold at franchised and independent dealers. Used vehicle sales slowed slightly in June compared to April and May, which is normal for this time of year. However, sales were up nearly 2% from a year earlier.

“Demand remains robust as consumers seek affordable vehicle options and aim to get the most value for their money, with some potential new-car buyers turning to the used market instead,” said Scott Vanner, manager of economic and industry insights at Cox Automotive, the parent company of Autotrader.

Today’s used car market continues to suffer from an ongoing lack of inventory. Manufacturers made 8 million fewer new vehicles from 2020 to 2022 due to COVID-19 supply disruptions. Unable to find a new car to buy or lease during that time, many buyers bought used cars instead, creating a tighter supply of used vehicles. With fewer leases in that timeframe, there will be a lower supply of vehicles for the used market for several years to come.

RELATED: Used Car Buying Guide

How Much Does a Used Car Cost?

The vAuto Live Market View data, analyzed by Cox Automotive, shows that the average used car listing price was $25,512 at the start of July, with an average mileage of 73,003. The average list price ticked up slightly, by 1%, compared with last year.

If not paying in cash, consumers buying a used car need to finance their purchase. Consumer car loan interest rates have remained high during the past several years, making it harder to afford a used car. Use our car affordability calculator to see what you can buy within your budget.

According to the vAuto data, nearly 2.2 million used vehicles were available for sale at the beginning of July, which is about the same as last year and in June. If you are in the market for a used car right now, narrow your search by filtering your results to see cars for sale by owner, at a dealership, or those in a certain price range.

Data show that sales of certified pre-owned (CPO) vehicles decreased slightly month over month in June, though they are down nearly 4% year over year, as there were fewer sales days. CPO vehicles are usually lower-mileage cars in excellent condition that are sold with the backing of the manufacturer. With an extra warranty, certified pre-owned vehicles can be a good deal, especially if there’s special financing and low down payments that go along with the car.

RELATED: What Is a Certified Pre-Owned Car?

June’s CPO sales are estimated at 200,950 cars, down from May sales of 231,137 cars.

“With new car prices rising, it might make sense to consider an older used car,” said Brian Moody, executive editor of Autotrader. “If you go out of your way to find a reliable model, it should last many years.”

Pros of Buying a Used Car This Month

- Tariffs on new cars could drive up prices for used vehicles in the coming months due to greater demand.

- New cars quickly depreciate once driven off the lot, making buying used a smarter idea any month of the year.

- Insuring a used car costs less than a new vehicle in most cases.

Cons of Buying a Used Car This Month

- Waiting for lower car loan interest rates in the months ahead may make sense if you need to finance your used car purchase. However, there’s no telling if car loan interest rates will decline.

- Buying a newer-model used car can be more expensive than buying a new one in some instances.

- Dealing with a lack of inventory may mean you can’t find the car you want.

Tips for Buying a Used Car in Today’s Market

With several factors impacting used car buying, use the tips below to find the right one that fits your budget.

- Research used car models to find the best deal with dealerships and private sellers.

- Ask for the vehicle history report to learn about its maintenance and any accidents.

- Check the used car’s Kelley Blue Book value from our sister site to see if it’s a good deal.

- Get the best offer on your trade-in by shopping it around.

- Compare rates for your used car loan before settling on financing.

- Set your budget and use our car affordability calculator to determine what works best for you.

- Look for certified pre-owned manufacturer offers and other deals.

- Obtain quotes for car insurance before buying.

- Avoid signing any dealership sales agreement before seeing a cost breakdown of all line items.

Bottom Line

You might find some good deals before used car inventory tightens further. It might not be the exact vehicle you want. Always consider your personal circumstances when deciding whether it’s the right time for you to make the leap and buy a car. Do your research before deciding on buying used, and if it’s a newer model used vehicle, be sure to check the price of new cars and compare costs.

My grandson just perchased a 2016 Kia on Facebook market place. Beautiful car like new inside but uses four quarts of oil per ten/fifteen gallons of gas

Can someone explain the annual dip in Days of Supply that appears to bottom out each March?

How much impact does that have on the price of used cars?

Finally, should prospective buyers wait a month for those numbers to recover before buying or is that likely to be when prices become affected by tariffs?

Thanks for reading, Darrel. The dip is all about tax refund season. Tax refunds drive the highest demand of the year because buyers have more money to use as a down payment. More money in consumers’ pockets means more demand soaking up supply. In general, supply rises after tax refund season for the rest of the year. Last year, sales stayed higher than normal through December, so dealerships didn’t get to ‘rebuild’ supply as much as usual and we started off 2025 lower than we normally do.

Wholesale prices usually rise due to tax refunds, and impact retail prices with a 4-6 week delay. February and March often see lower retail prices because dealers bought cars in December when prices are lowest. Tariffs could further increase used retail prices.

My comments are:

Can we ask why is this president hurting consumers ?

Can organizations question the president ti stop this?